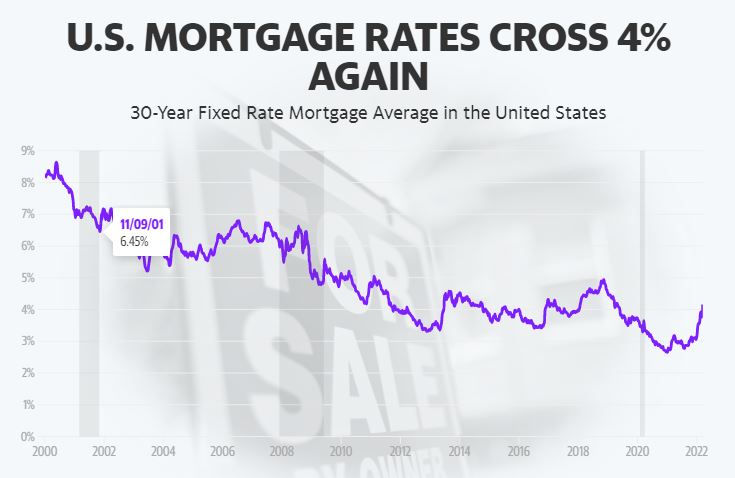

Mortgage rates soar past 4%

- Gabriella Cruz-Martinez

- Mar 19, 2022

- 2 min read

Mortgage rates hit their highest level since April 2019 this week, following a sharp increase in 10-year Treasury yield.

The rate on the average 30-year fixed rate mortgage jumped to 4.16 %, up from 3.85% a week ago, according to Freddie Mac. The 15-year fixed rate — a common refinance option — also surged, averaging 3.39% from 3.09% last week.

The more than quarter-point hike in rates in the last week is a blow to many homeowners who may have waited too long to refinance their loan. It's also yet another setback for buyers who are facing some of the worst affordability conditions, as prices push higher amid stubbornly low inventory for homes for sale.

"The potent fuel that propelled real estate markets to new highs over the past couple of years is evaporating,” said George Ratiu, Realtor.com manager of economic research.

Rates have marched up notably in recent weeks as rattled markets responded to inflation concerns that ratcheted up even more after the U.S. banned oil imports from Russia.

The Federal Reserve’s move to hike short-term interest rates by a quarter-point on Wednesday, with at least five more increases expected this year, is unlikely to slow inflation anytime soon, according to Ratiu, given the ongoing supply chain issues and the effect of higher fuel costs on consumer prices. The ongoing uncertainty over the war in Ukraine is also helping to boost the 10-year Treasury yield, which fixed mortgage rates tend to follow.

"The Federal Reserve raising short-term rates and signaling further increases means mortgage rates should continue to rise over the course of the year," said Sam Khater, Freddie Mac’s chief economist. “While home purchase demand has moderated, it remains competitive due to low existing inventory, suggesting high housing price pressures will continue during the spring home-buying season.”

Comments